Al Ameera Village in Ajman has continued to attract both investors and end-users over the past year. The project’s mix of affordability, flexible payment plans, and strong rental demand has resulted in steady price appreciation across unit types, particularly studios and one-bedroom apartments.

Price Growth (2024–2025)

Table of Contents

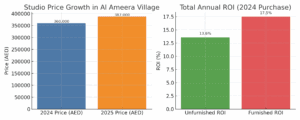

In mid-2024, ready studios in Al Ameera Village were selling in the range of AED 356,000 to AED 366,000. These prices made the project attractive to both investors seeking high rental yields and end-users looking for affordable ownership. Strong demand from both local and expatriate buyers contributed to quick absorption of available inventory.

By August 2025, comparable ready studios are now listed for around AED 387,000. This increase of AED 21,000 to AED 31,000 per unit reflects an annual appreciation rate of roughly 6% to 9%. The growth is notable for a market segment that is already considered affordable, showing that budget-friendly properties can also deliver solid capital gains.

Several factors supported this price rise. The project’s location within Ajman offers good connectivity to Dubai and Sharjah, while the availability of both ready and off-plan units attracts a diverse pool of buyers. High rental demand, especially from professionals and small families, also sustained upward pressure on prices, making Al Ameera Village one of the more resilient sub-markets in the past year.

Rental Performance

Ready studios in Al Ameera Village have maintained strong rental demand over the past year, supported by the area’s affordability and convenient location. Unfurnished studios are currently renting for around AED 22,000 per year, offering an attractive entry point for tenants seeking budget-friendly options. Furnished studios command higher rates, averaging AED 36,000 annually, catering to professionals and expatriates who prefer move-in-ready homes.

The difference in rent between unfurnished and furnished units highlights the added income potential for investors willing to furnish their properties. Even at the lower unfurnished rate, yields remain competitive compared to other UAE markets. With steady occupancy levels and consistent tenant interest, rental returns in Al Ameera Village continue to offer investors a reliable income stream alongside the benefit of ongoing capital appreciation.

Investment Returns – Example Calculation

An investor who purchased a ready studio in Al Ameera Village in mid-2024 for AED 360,000 would have seen solid gains over the past year. In the unfurnished rental scenario, the property would generate AED 22,000 in annual rent, translating to a rental yield of approximately 6.1%. Combined with an estimated AED 27,000 in capital appreciation, the total return reaches about AED 49,000 in one year, or 13.6% of the initial investment.

For those opting to furnish their units, the returns are even stronger. A furnished studio would rent for around AED 36,000 annually, delivering a 10% rental yield. Adding the same AED 27,000 in price growth, the total annual gain rises to about AED 63,000, representing a return of roughly 17.5%. These figures illustrate how both capital appreciation and strategic furnishing choices can significantly enhance overall investment performance in Al Ameera Village.

| Scenario | Rental Income (AED) | Rental Yield | Capital Appreciation (AED) | Total Annual Return (AED) | ROI |

|---|---|---|---|---|---|

| Unfurnished Rental | 22,000 | 6.1% | 27,000 | 49,000 | 13.6% |

| Furnished Rental | 36,000 | 10% | 27,000 | 63,000 | 17.5% |

Price & ROI Comparison

Key Takeaways for Investors

- Al Ameera Village has shown stable and consistent price growth over the past year.

- Rental yields remain high, especially for furnished units.

- Combining rental income and capital gains, investors in 2024 achieved between 13% and 18% returns in one year.

- Demand for ready units remains strong due to affordable entry prices and immediate rental potential.

Conclusion

Al Ameera Village continues to stand out as a solid investment opportunity in Ajman’s real estate market. With prices on the rise, healthy rental yields, and growing demand, it presents a compelling case for both short-term income and long-term capital growth.

If you are looking for an opportunity to invest in the Ajman real estate market, fill in your details below and our team will contact you. You can also reach us directly via WhatsApp for faster assistance.